Itrustcapital login — Solicitation Guidance: Offers for Digital Assets & Alternative Investments

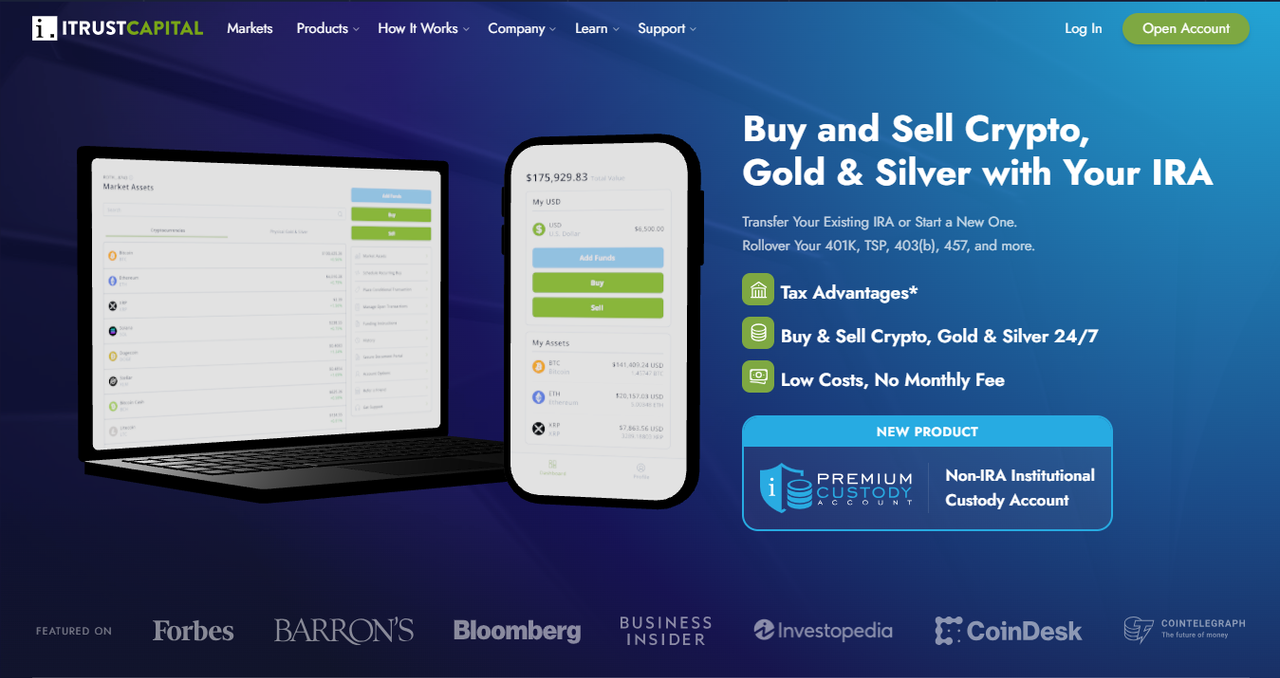

This guidance explains how to evaluate any solicitation of an offer to buy a digital asset, alternative investment, or security, and how to safely use your Itrustcapital login for account access and custody workflows. This page is educational only — not an offer or investment advice.

Itrustcapital login — Quick Summary

Any solicitation related to purchasing a digital asset, alternative investment, or security should be treated with caution. Use Itrustcapital login only after you verify counterparties, review formal disclosures, and confirm compliance with custodial and retirement-account rules.

Itrustcapital login — Legal & Regulatory Context

Solicitations can trigger securities, tax, and fiduciary obligations. Before acting on any offer you receive, confirm whether the offering is registered or exempt, and whether the proposed purchase is permitted in your account type (IRA, trust, taxable account). Your Itrustcapital login does not replace these legal requirements.

Itrustcapital login — Due Diligence Checklist

- Verify the source: Confirm the solicitor is a licensed entity (registered dealer, investment advisor, or issuer). Independently validate credentials (registry lookup, company filings) rather than relying on the message sender.

- Obtain formal disclosures: Insist on a prospectus, private placement memorandum (PPM), subscription agreement, or other regulatory filings — read them thoroughly or have counsel review them.

- Check account permissibility: Confirm with your custodian whether your account type permits the proposed purchase and whether any trustee or custodian approvals are required before using Itrustcapital login to fund the purchase.

- Confirm custody & settlement mechanics: Understand where the asset will be held, who the custodian is, how title is recorded, and how transfers/settlements will be executed via your Itrustcapital login.

- Validate liquidity and valuation: Ask for historical pricing, redemption/exit terms, valuation methodology, fees, and any lock-up periods that affect your access to funds.

- Perform conflict & background checks: Check for regulatory actions, litigation, or negative press involving the issuer or promoters.

- Consult licensed professionals: Before committing funds, consult qualified financial, tax, and legal advisors about suitability, tax consequences, and fiduciary implications.

- Confirm auditable funding flows: Fund only through official custodian or Itrustcapital login channels; insist on written receipts and retain records for tax and compliance.

Itrustcapital login — Red Flags & Phishing Alerts

Watch for urgency, lack of documentation, unsolicited private key requests, unverifiable claims, or demands to transfer funds outside custodian channels. Any request to enter credentials outside the official Itrustcapital login portal is a high-risk phishing indicator.

- Pressure to act immediately or “limited time” offers

- No formal offering documents provided on request

- Requests to deposit funds to unfamiliar wallets or personal accounts

- Unsolicited attachments or links that redirect away from official sites

- Claims of guaranteed returns or improbable yield projections

Itrustcapital login — Practical Safe Workflow

A defensible workflow after receiving a solicitation:

- Stop and verify the sender via independent channels (website, phone). Do not reply to the original message.

- Request formal disclosures and a timeline for the offering.

- Review permissibility with your custodian — do not attempt funding through Itrustcapital login until approved.

- Document all steps and keep copies of communications, disclosures, and transaction receipts.

- If suspicious, report to your custodian, platform support, and the appropriate regulator (e.g., securities commission or consumer protection agency).

Itrustcapital login — Operational Notes for iTrustCapital Users

If you hold retirement accounts with iTrustCapital, any non-standard investment typically requires additional approvals and documentation. Use your Itrustcapital login only after the custodian confirms the transaction is permitted and the settlement instructions are clear and auditable.

Itrustcapital login — Contact & Reporting

If you suspect fraud or phishing related to Itrustcapital login, contact your custodian or platform support immediately and preserve all communications and transaction attempts. You may also consider filing a complaint with your local securities regulator.